Generally, you have three years from the original tax return deadline to file the return and claim your refund. Also, most delinquent return and SFR enforcement actions are completed within 3 years after the due date of the return. However, in practice, the IRS rarely goes past the past six years for non-filing enforcement.

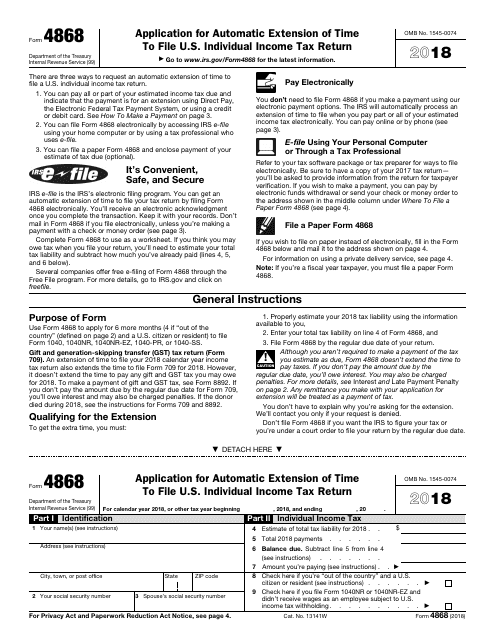

The IRS can go back to any unfiled year and assess a tax deficiency, along with penalties. How far back can the IRS go for unfiled taxes? For offline mode, you have to visit the office of income tax department of your city and have to manually fill income tax return form. Procedure to file Income Tax Return (ITR) for previous years Income tax return for previous years can be filed through offline and online mode. Filing this form gives taxpayers until Oct. In a matter of minutes, anyone, regardless of income, can use this free service to electronically request an automatic tax-filing extension on Form 4868. The fastest and easiest way to get the extra time is through the Free File link on IRS.gov. What is the easiest way to file a tax extension? So if you’re filing 2020 taxes but miss filing by May 17, 2021, you still have until November 2021 to e-file. The IRS announces in October when exactly it will stop accepting e-filed returns for that tax year. At this point, you can only prepare and mail in the paper tax forms to the IRS and/or state tax agencies. The timely tax filing and e-file deadlines for all previous tax years – 2020, 2019, and beyond – have passed. Filing your return electronically is faster, safer and more accurate than mailing your tax return because it’s transmitted electronically to the IRS computer systems.

Yes, you can file an original Form 1040 series tax return electronically using any filing status. To get the extension, you must estimate your tax liability on this form and should also pay any amount due.Ĭan you electronically file a 2016 tax return in 2020? Filing this form gives you until October 15 to file a return. Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. You’ll receive an electronic acknowledgment once you complete the transaction. You can get an automatic extension of time to file your tax return by filing Form 4868 electronically.

IRS e-file is the IRS’s electronic filing program. You can file a paper Form 4868 and enclose payment of your estimate of tax due.

0 kommentar(er)

0 kommentar(er)